Making the right investments is everyone’s concern nowadays. Even how little extra money one has, there is always the intention of investing it somewhere. With people who like to start with something small for an investment because of limitations in funds and the lack of expertise in investments, buying penny stocks should be the right move to take. It involves a small investment but carries the possibility of a bringing in a fortune.

Just like the normal stock investments, investing in penny stocks should be done with care so as to avoid too much risk and loss. Many investors find it convenient to invest in penny stocks because it does not require a big cash outlay to invest in a small but good company.

What are penny stocks?

Penny stocks are the kind of stocks that are bought for a fraction of a penny to $5. This kind of investment although riskier than other stock investment sometimes turns out to be profitable. Before, these stocks are considered to be of high risk because information about the companies selling penny stocks is very limited. There is little transparency in the company’s financial information.

Many companies that have started as small companies sold penny stocks to get started. These companies have great potentials of becoming big. They just have to get started and be discovered that is why they start small. Once business picks up then the company increases the price of their shares of stocks.

How to invest in penny stocks

Like in all stock investments, to invest in penny stocks you have to have a brokerage account. You can get the help of penny stock brokers who can tell you everything that you need to know about penny stocks. The stock broker assisting you can advice you on what are the best penny stocks in the market.

To get started you have to get in touch with a penny stocks broker and open an account with them. You simply need to contact a brokerage service and open an account with them, and then you can start trading penny stocks.

Through these brokers you get to learn how to buy penny stocks, and invest on the best penny stocks. Getting the hang of it with careful study of the market and putting in some guts feel can lead you to the right direction in your trading in penny stocks.

How to get the best penny stocks

If you happen to be new in the stock market your stock broker can help and guide you on how to pick penny stocks. The assistance of these brokers can either make or break your venture in the stock market. Since you are a green horn in the field of stock market, the right thing to do is to invest in penny stocks.

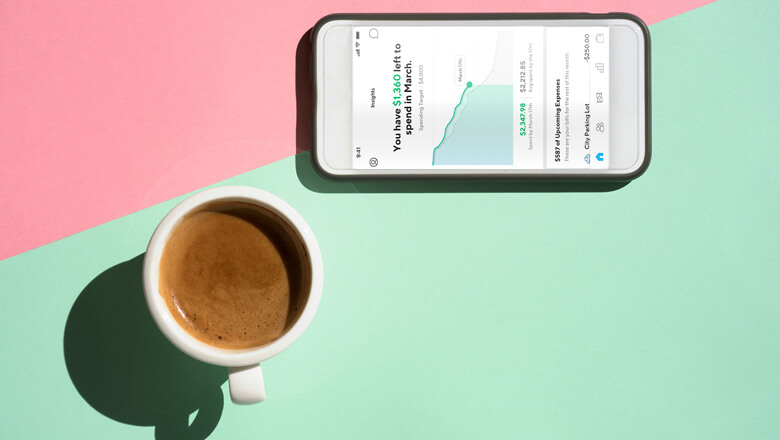

There are penny stocks online newsletters that you can use to make your picks on what penny stocks to buy. These newsletters will guide you on making the right picks with the company information they have in hand. Of course as always, utmost care should also be observed as many of these services as not as accurate and truthful with their information as possible because they are being paid by companies to give good and positive reviews. Make sure that the reviews you get are unbiased, informative and truthful.

A careful study of the company you are considering in your purchase of penny stocks is very important. Try to get to know as much as you can about the company, how it is making money and where you see the company will be in the coming years. These considerations can have a very important impact on your choice of what penny stocks to purchase.

Here are some points to consider so you will be assured of getting the best penny stocks:

The penny stocks you are considering should have a good trading volume to make trading of shares easier and the possibility of an upward price movement is evident.

Make sure that the shares you are considering are on a good penny stock market like Nasdaq SmallCap or AMEX because they regularly present a report to shareholders and follow strict exchange requirements.

Check on the company’s financials to see if they are making money and if their operational schemes and plans are workable.

Check for signs of improvement in the company that will cause an increase in the price per share of the penny stocks.

Watch penny stocks movement in the market.

Depend and rely on reviews of the professionals and penny stock brokers for decisions you have to make regarding the penny stocks you are considering to buy and trade.

Just a word of caution in buying penny stocks, do not even try to invest penny stocks from the free stock picks. These are penny stocks offered through email spam, offers sent through fax or even through calls made by fictitious brokers. Doing so will put you in great risk because the information you will be getting from all these are not very reliable since these people are being paid by certain companies to make a good and deceiving reviews about their company in order to get investors. If you resort to buying penny stocks through free stock picks the possibility of losing your investment is greater. You will be at a losing end.

Getting involved in penny stocks is a very challenging and risky thing to be in. There are risks that are involved like the prices of the penny stocks are unstable and the company’s financial information is not that transparent for close monitoring of financial movement. Despite all these risks, a lot of people find investing in penny stocks exciting and profitable. With a little investment there is always the possibility of making it big by getting their hands on the right penny stocks. If you have what it takes to make it big in the stock market but would like to play safely and conservatively, investing in penny stocks is for you.