In order to determine whether investing in penny stocks is right for you, you’ll need to take a careful and honest look at various criteria, always being mindful of your risk profile and of course, of your available disposable capital possibilities. Some of these criteria have to do with your own abilities—that is, with things that you can control—while others have to do with things that lie far outside of your own control and thus, must simply be accepted for what they are. Let’s get you started by discussing what you should be considering, so that you can make the most informed choice.

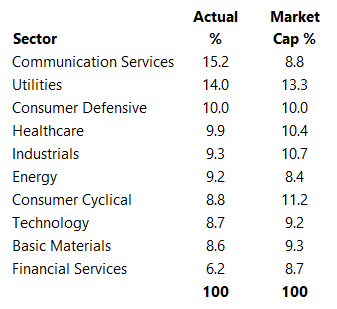

Of primary concern to any investor should be careful consideration of their appetite for risk, and every investor should be able to state whether their risk appetite is low or high. Typically, investors with the lowest risk appetite are also the most conservative, and thus, such investors usually do not invest for growth; instead, they’re more prone to invest for long-term value, and may fill their portfolio with blue-chip stocks, dividend-paying stocks, municipal bonds and similar traditionally low-risk investment vehicles. Often, such investors represent an older demographic, and are switching their investment strategy from high-yield, growth-oriented products to such conservative investments specifically to protect the profits which they had generated earlier in their investment career, which is a well-known and highly worthwhile strategy.

Investors with a higher risk profile are typically younger and not necessarily yet concerned with building a portfolio that can assist them in maintaining their accustomed standard of living after having reached retirement age. They’re professional, and have a certain degree of disposable income which they’d like to use to maximize their investment earnings potential through more aggressive, and correspondingly risky, equity purchases. It’s often the case that investors with a higher risk appetite are those who have already achieved a measure of investment success and thus, being confident in their ability to research and identify solid growth picks on their own, want to continue to ride their momentum for as long as they can. Either way, such investors are perfect penny stock investment candidates.

The risks associated with penny stock trading are paradoxically both low and high at the same time, and your interpretation of these risks is simply a function of your attitude. Those who profess that the risks are unwarranted are those who focus on the less regulated climate of the penny stock market, equating regulation with safety, and who are put off by the high volatility of penny stocks. In general, those who view the risk of trading in penny stocks as being low are those who recognize that because the buy-in, that is, the amount of capital needed to purchase penny stocks, is so low, there’s only upside: the risk of loss is deemed to be minimal, yet the corresponding possibility of riding a small-cap equity to its breakthrough to genuine shareholder value is high, particularly if the small-cap investor has done thorough research; further, the opportunity to get in on the proverbial ground floor and realize exponential gains only exists in the penny stock markets.

While penny stocks may indeed be less regulated, they are by no means the equity version of the Wild West. The OTC markets are more regulated than the novice investor may realize, and a wealth of information is indeed available on penny stock issuers. Although you may not be able to control the amount of official filings issued by small-cap companies, you can supplement whatever public information is available by undertaking your own research. Check industry and trade websites, check out investor boards and forums, and check in with the company’s own investor relations department o gain further insight into the larger picture and provide yourself with the material you need to make informed investment decisions. If you are skilled in the usage of analytical tools and charting, spend some time going over the stock’s history, in terms of share price and volume, to get a feel for momentum and trends, if any. It’s simply not as hard as people think to gain a complete picture of a small-cap company, and it’s obvious that if you cannot find the necessary information regarding a penny stock issuer, and if your research—and your gut instinct—tell you not to invest, then move on: there’s over 10,000 companies listed on the OTC Markets, and you should not reject them all out of hand. Keep looking, and you’ll be certain to find a few penny stock picks that fit both your risk profile and your research skill level. Start with a small investment to minimize your risk of loss, and gain confidence through your experience. With very few exceptions, penny stocks indeed are right for almost everyone.