A while back now, I looked at US stock sectors and the number of dividend champions they produced to see if there were any dividend-champion friendly sectors. I’ve used this train of thought to overhaul how I am weighting my stock portfolio. Are you sitting comfortably? Then I’ll begin…

What’s gone before

Previously in Dividend Life, I weighted my portfolio fairly equally across all 10 market sectors, as opposed to how the S&P Index is weighted. My thinking here was that if one sector in my portfolio lagged behind the others, then it must contain relatively cheaper stocks so I should add to that sector and get some relative bargains. In reality, because the new capital was significantly larger than market variation, the new purchase disturbed the results so I would end up cycling through each sector with little variation between the sequence. This effect would be less pronounced the larger the portfolio when the market price is more of a factor than new capital added.

Going forward

I already have one self-weighting rule in my Charter that I really like:

Never let any single stock contribute more than 5% of my annually projected dividend income.

This is simple risk management – if one of the stocks in my portfolio melts down and cancels its dividend then I lose no more than 5% income. This rule can’t be achieved if you own only a few stocks, so it inherently forces diversification which is a good thing – the 5% number itself is entirely arbitrary.

I’ve decided to take a step further and weight my portfolio based on dividend income percentages rather than market capitalization dollars. This has several impacts which I’ll eventually get to further below.

New dividend portfolio sector allocation

The sectors I use are those defined at Morningstar and they match those used in the US Dividend Champions List (although with slightly different names). Category is a higher level grouping also from Morningstar which groups stocks into one of three ‘super-sectors’: Defensive, Sensitive and Cyclical.

I started out with an base allocation for each sector based on their category, added a relative weight within that category and total the amounts to get the following.

| Sector | Category | Base % | Adjustment | Final % |

| Utilities | Defensive | 12 | +1 | 13 |

| Consumer Defensive | Defensive | 12 | 0 | 12 |

| Healthcare | Defensive | 12 | -1 | 11 |

| Communication Services | Sensitive | 10 | +1 | 11 |

| Energy | Sensitive | 10 | +1 | 11 |

| Industrials | Sensitive | 10 | -1 | 9 |

| Technology | Sensitive | 10 | -1 | 9 |

| Consumer Cyclical | Cyclical | 8 | +1 | 9 |

| Basic Materials | Cyclical | 8 | 0 | 8 |

| Financial Services | Cyclical | 8 | -1 | 7 |

Comparison to dividend champions per sector

These weightings match reasonably well to the percentage of dividend champions per market sector that I reviewed previously. I didn’t try to match the exact percentages but I did use the order of the previous ranking to help guide my decision. The table below compares them.

| New | % | Ratio of Champions per sector | % |

| 1. Utilities | 13 | 1. Utilities | 17 |

| 2. Consumer Defensive | 12 | 2. Consumer Defensive | 14 |

| 3. Healthcare | 11 | 3. Communication Services | 12 |

| 4. Communication Services | 11 | 4. Energy | 12 |

| 5. Energy | 11 | 5. Healthcare | 9 |

| 6. Industrials | 9 | 6. Consumer Cyclical | 8 |

| 7. Technology | 9 | 7. Basic Materials | 8 |

| 8. Consumer Cyclical | 9 | 8. Industrials | 8 |

| 9. Basic Materials | 8 | 9. Financial Services | 7 |

| 10. Financial Services | 7 | 10. Technology | 6 |

I favor the Healthcare and Technology sectors more and have reduced Basic Materials allocation compared the dividend champions percentage values.

Using the weightings

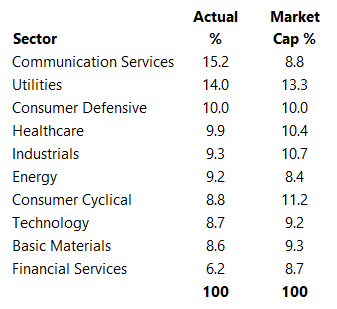

Using these values is quite simple – I’ll use the percentages here to stop purchases stocks in a sector if the annualized dividends from that sector exceed the target percentage plus one percent. Here’s my current portfolio allocation comparing the actual and target values.

So I won’t be buying Communication stocks for a while, but as I add stocks from other sectors the over-allocated sectors will decrease and eventually balance out in one big happy portfolio.

And just for fun…

Here’s the comparison between my dividend portfolio sector allocation based on dividend percentages and the allocation based on market capitalization.

Dividend portfolio sector allocation two ways: Dividend percentage allocation vs. market value allocation

The main factor here is dividend yield which links market capitalization (share price) and dividend income (dividend per share). High yield stocks such as those in the Communications sector do not need as much market value to contribute a higher percentage of dividend income. And conversely, a larger amount of lower yielding stocks are needed to contribute the same overall income percentage than higher yielding stocks.

Summary

Based on the market capitalization above, I shouldn’t expect my portfolio to beat the S&P 500 in terms of total return since it’s oriented towards defensive, lower growth stocks. I should expect higher dividend income however which is what this is all about. Because I’m planning to use only dividend income from this portfolio in retirement and not sell the stocks I’m not particularly worried about total return or capital gains.

The goal of this allocation is to try to mitigate risk of reduction in dividend income by favoring market sectors that are more reliable for long term dividend growth and to limit the dividend income from each sector. Only time will tell if this allocation is successful or not!