Are you new to trading and want to master the basics? Well, we would recommend learning about the balance sheet as soon as you can. It can be a useful tool that will help you make trading decisions.

What is the Balance Sheet?

If you spend some time in trading chat rooms, you will inevitably hear about balance sheets. And, you will probably notice that a lot of people pay close attention when someone brings it up. Well, they do so for a reason. But why?

To put it simply, the balance sheet is one of the primary financial statements of a company. In fact, it is one of the most useful documents you can put to use while evaluating a firm. Its job is to inform you, as an investor, of the financial standing of the company.

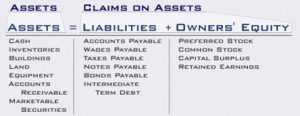

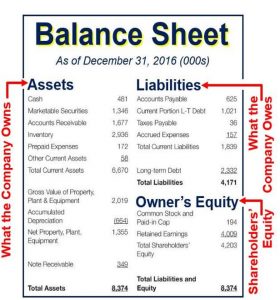

There are two main sections in a balance sheet. The first one (usually on the left-hand side) is there to inform you about the assets. This section will include anything that the company owns that has actual financial value.

The second one (usually on the right-hand side) is for liabilities and equity of shareholders. Liabilities present the company’s debt. Most commonly, they refer to bond issues and bank loans. However, anything that the firm owes to someone is a liability.

Owners’ equity (or stockholders’/shareholders’ equity), on the other hand, consists of the stock of the company and the income it holds from operations. This income is known as retained earnings. The company can use liabilities, its stock, or owners’ equity to purchase assets. So, if we were to present the balance sheet in an equation, it would look like this:

Shareholders’ Equity + Liabilities = Assets

This equation is one of the original concepts accountants have been using for a long time. To put it in words, assets of a company are equal to the liabilities of a company plus the shareholder’s equity. And, it does make sense. Allow us to simplify. In order to buy something, a company has to pay for it. In order to do so, they either have to use their earnings, sell stock in the same value, or take out a loan. And, of course, this simple equation works for every single company. No matter how big it gets or how small it starts. In fact, you can even apply the formula to a lemonade stand your neighbor’s kid is running.

Allow us to demonstrate: Let’s say the child spent 10 dollars to make the lemonade stand. Let’s also say that it got a 10 dollar loan from the parents to buy lemons, sugar, and straws. With that situation in mind, let’s make a simple balance sheet.

Assets

Supplies: 10 dollars

Property: 10 dollars

Total Assets: 20 dollars

Liabilities and Shareholders’ Equity

Liabilities: 10 dollars

Shareholders’ Equity: 10 dollars

So, let’s take a look at this basic balance sheet to figure out how it works. The kid spends the 20 dollars on the business overall and has no cash at the moment. However, the “books” still show 20 dollars in assets. After all, the supplies for making the lemonade are still all there. The kid owes the parents 10 dollars, which are there as a liability. And lastly, as the owner, or the sole stockholder, the “company” has 10 dollars of equity. Hopefully, this example was helpful. Now that we can grasp the basics of balance sheets let’s delve a bit deeper into the details.

The Assets

Our example was very simple, but in the real world, it can get a bit more complicated than that. So, let’s go through some common assets. The most common examples are cash, inventory, property, plant and equipment (PPE), accounts receivable, and goodwill. Now, most people will instinctively understand a couple of these terms. However, other items on the list are not quite as self-explanatory as cash or inventory – for example, account receivable. It is an item that represents liabilities that clients owe to the company. Since they represent the money that others owe to the company, they are that company’s assets. PP&E is the account that summarizes all of the property the company has, the plants it uses for manufacture and any equipment it owns.

You can further classify assets as current or noncurrent assets. The current ones are those that the company will use up in one year (for most companies, the year is the length of one business cycle) or the assets that the company can easily convert to cash. The noncurrent ones, on the other hand, are those that are going to remain on the balance sheet for longer. An example of noncurrent assets is the land the company owns.

But, is it possible to have too many assets? Actually, it is. Bear in mind that the company has to pay for every asset with its equity or through liabilities. Especially if the company is buying unnecessary assets. That can lead to increasingly difficult debt or devaluation of the stocks as they are overselling. And, if the company is buying too many assets, the investors might lose money through devaluation of their holdings.

Also, having stagnant assets can increase the costs of operation, and thus reduce the profit margins. While most assets are a good thing, there are those that the company won’t be able to sell. And, not only does the upkeep cost rise the more stagnant inventory you have, but it takes more time to move it. And, over time, the inventory might become obsolete and lose value. So, make sure to check the inventory turnover if you see a company that has a lot of assets.

You should also bear in mind that certain assets (like PP&E) will depreciate as years go by. For example, if a company buys a building for 10 million dollars, and plans to use it for 10 years with no residual value, the depreciation rate would be 1 million dollars per year.

The Liabilities

While liabilities represent the debt of the company, they aren’t necessarily a bad thing. After all, they allow the company to buy assets they otherwise would not be able to afford. In fact, almost every single large company in the world has had debt in their books. And, it makes sense in the short term – borrowing money is a great way to improve your business.

Most common liabilities are bonds payable, mortgages, and accounts payable. However, even if you find a company with little to no liabilities on the balance sheet, it doesn’t mean you have found a company that has no financial obligations. Some companies might try to hide their debts by rewording the balance sheet. So, keep your eyes open to see if the footnotes of the financial statement hide something you should know about. Sometimes, the company might list debts as “operating leases” or “other transactions.” In fact, while there is no reason to hide existing assets, it could be appealing for companies to hide liabilities. Just remember the Enron scandal.

And lastly, always check if there are red flags when it comes to company’s debt. The last thing you want is to be an investor in a company that is about to default on its debt.

The Shareholders’ Equity

This is one of the trickier sections of the balance sheet. There are multiple topics that affect this section, and they require some knowledge to understand fully. Some of these topics are multiple stock classes, equity financing, subsidiaries, and many others. So, make sure to take the time and go over this section in detail if you are an investor in the company. This part of the balance sheet is the part where the company speaks about what you own.

The Limitations of The Balance Sheet

While balance sheets are definitely useful, they have their limitations, depending on what you want from them. First of all, balance sheets are financial statements, and, as such, they follow the guidelines GAAP and the FASB set up. So, why do we mention that? Well, primarily because the balance sheet doesn’t show the fair value of most items. That is mostly due to the practice in the accounting industry referred to as lower of cost or market.

This practice dictates that the accountant recording the asset uses the lower of two values between the fair value and the cost of the asset. This way, the accountant can’t inflate the numbers it records on the balance sheet. Let’s go back to that lemonade stand. When it makes lemonade out of the ingredients worth 10 dollars, the lemonade itself is worth a lot more. So, the kid expects to sell the inventory for 50 dollars instead. That means that while the cost was 10 dollars, the market value is 50. However, the balance sheet will still show that the “company” has 10 dollars worth of assets.

If the company ever sold all of the assets, the result would not be equal to the balance sheet numbers.

Maintaining the Balance

Financial statements can be quite intimidating. In fact, not all investors take the time to investigate them. However, they can be incredibly powerful tools for analysis. And the Balance Sheet is one of the financial statements that you can investigate even when you don’t have a lot of time. It holds a lot of information you can successfully use to predict what the future holds for the company. Just remember – there is a learning curve to investigating these statements. So, make sure to take your time and develop your knowledge.