Making a Go with Penny Stocks

Making the right investments is everyone’s concern nowadays. Even how little extra money one has, there is always the intention of investing it somewhere. With people who like to start with something small for an investment because of limitations in funds and the lack of expertise in investments, buying penny stocks should be the rightContinue reading →

Are Penny Stocks Right For Me?

In order to determine whether investing in penny stocks is right for you, you’ll need to take a careful and honest look at various criteria, always being mindful of your risk profile and of course, of your available disposable capital possibilities. Some of these criteria have to do with your own abilities—that is, with thingsContinue reading →

Stock Analysis Using the Profitable Investing Strategy

An effective Stock Analysis has a pre-established series of steps just as our profitable investing strategy has a set of pre-established steps. Stock analysis is step 3 of the profitable investing strategy and assumes that Step 1 – Stock Market Analysis and Step 2 – Sector Analysis has been accomplished. Certainly, a stock analysis canContinue reading →

Penny Stock FAQ

1. What are Penny Stocks? Penny Stocks, according to the Securities and Exchange Commission (SEC), refers to low-priced (below $5), speculative securities of very small corporations. A penny stock is traded over OTC (Over the counter) through quotation services such as the Pink Sheets or OTC Bulletin Board. 2. Why Buy, Sell or Invest inContinue reading →

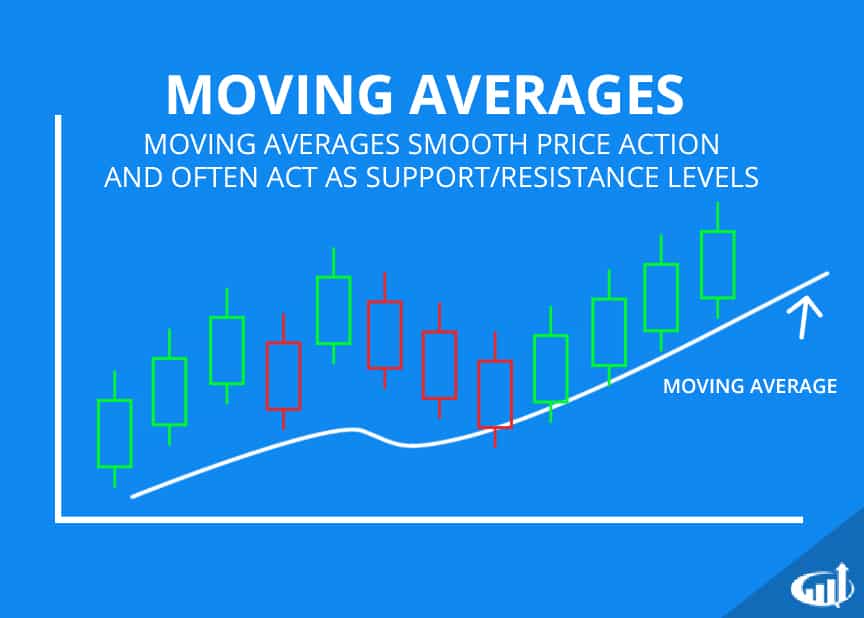

Guide to Moving Averages

Moving average is a term that is often being used when there is talk about trading, but what exactly is it and how can you use it in your own analysis? You probably know how to calculate the average of a pool of numbers but let us start with the basics. Average- and moving average-Continue reading →

How To Sell Stocks

Learning How To Sell Stocks properly is essential to profitable investing because buying a stock with a clear exit strategy is the only way to prevent huge losses from decimating your portfolio. Many investors manage to select the right stocks that are increasing in price at the time of purchase. The stock continues to increaseContinue reading →

Learn Stock Trading

If you seriously want to learn stock trading then you are in luck because with today’s technology its easier than ever before. The internet not only transformed the way we trade but it transformed the way we learn things. There are a number of great ways to learn how to trade stocks and I willContinue reading →

Binary Options Strategies – Chose Your Own Strategy

As binary options become increasingly popular and more widely available, the increase in binary options trading strategies is becoming more evident with each passing day. Many of these binary options strategies have been developed by investors that have used them to profit considerably from the markets. If you are looking to get your binary optionsContinue reading →

Artificial Intelligence Solutions For Maximum Trading Results

The Evolution of Trading A.I. Trading Technology needed to create a true revolution in trading technology on a scale the market had never seen before. We wanted to create trading systems that could study the market, learn from large quantities of data, adapt to the dynamic market environment, and grow client accounts on a consistentContinue reading →

My Dividend Portfolio Sector Allocation

A while back now, I looked at US stock sectors and the number of dividend champions they produced to see if there were any dividend-champion friendly sectors. I’ve used this train of thought to overhaul how I am weighting my stock portfolio. Are you sitting comfortably? Then I’ll begin… What’s gone before Previously in DividendContinue reading →